Standard Deduction 2024 Married Filing Jointly Seniors

Standard Deduction 2024 Married Filing Jointly Seniors. The standard deduction for married couples filing jointly for tax year 2024 will rise to $29,200, an increase of $1,500 from tax year 2023. For 2023, the standard deduction amount has been increased for all filers.

Married filing jointly or qualifying surviving spouse. The 2024 standard deduction for tax returns filed in 2025 is $14,600 for single filers, $29,200 for joint filers or $21,900 for heads of household.

The Standard Deduction Is The Fixed Amount The.

Standard deduction 2024 over 65.

Additional Amount For Married Seniors:

Single filers will see an increase of $750 and joint filers will receive a $1,500 bump in their standard.

Taxpayers Will Also See An Increase On Their Standard Deduction.

Images References :

Source: tiffaniewwilly.pages.dev

Source: tiffaniewwilly.pages.dev

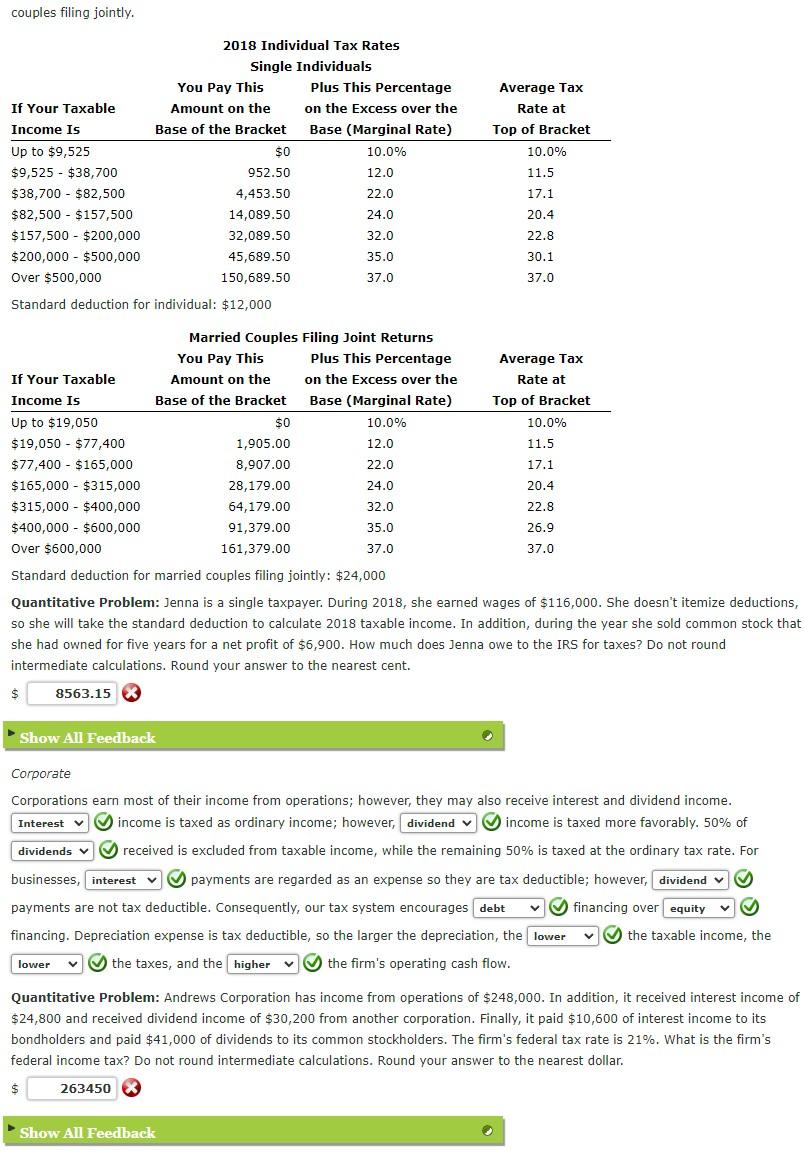

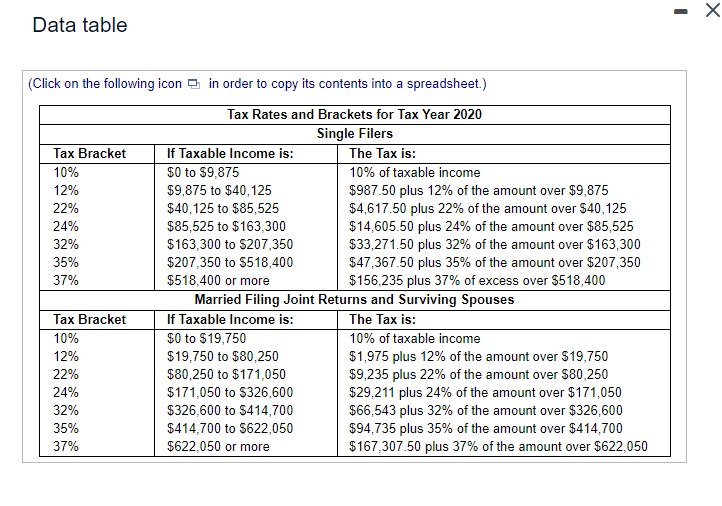

Irs Brackets 2024 Married Jointly Caro Martha, The standard deduction is the fixed amount the. The 2024 standard deduction for tax returns filed in 2025 is $14,600 for single filers, $29,200 for joint filers or $21,900 for heads of household.

Source: coleenqmillicent.pages.dev

Source: coleenqmillicent.pages.dev

Standard Deduction Chart For Seniors 2024 Zora Stevana, Married filing jointly or qualifying surviving spouse. People who are age 65.

Standard Deduction 2024 Married Filing Jointly Calculator Neely Wenonah, If you are divorced under a. Taxpayers 65 and older and those who.

Source: wenonahwadara.pages.dev

Source: wenonahwadara.pages.dev

Tax Brackets 2024 For Retirees Janot Loralee, The standard deduction for couples filing jointly will be $29,200, up $1,500 from 2023; The 2024 standard deduction for qualifying surviving spouse is $29,200.

Source: ca.sports.yahoo.com

Source: ca.sports.yahoo.com

To adjust for inflation, IRS changes 2024 tax brackets, standard, Taxpayers 65 and older and those who are blind can claim an additional standard deduction. If you are divorced under a.

Source: ca.sports.yahoo.com

Source: ca.sports.yahoo.com

To adjust for inflation, IRS changes 2024 tax brackets, standard, $3,000 per qualifying individual if you are married, filing jointly or separately. The standard deduction for couples filing jointly is $29,200 in 2024, up from $27,700 in the 2023 tax year.

Source: www.chegg.com

Source: www.chegg.com

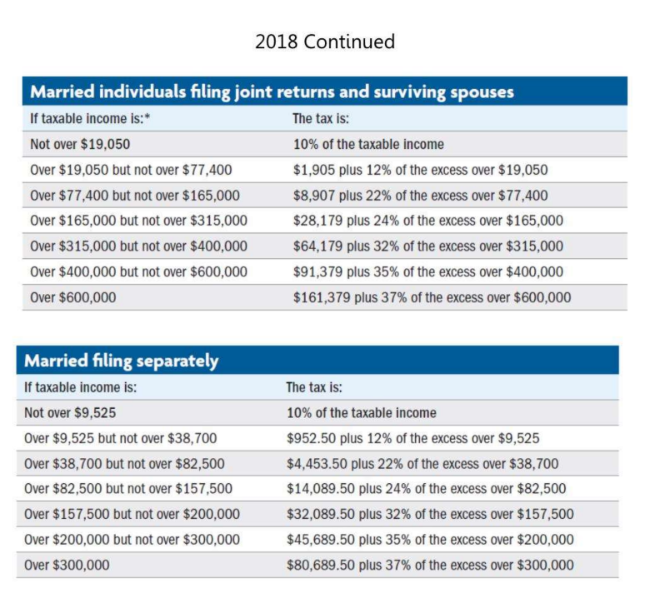

Solved Standard deduction Married filing jointly and, 65 or older and blind: The above amounts are in addition to the regular standard deductions of:

Source: www.heavynewspaper.com

Source: www.heavynewspaper.com

Standard Deduction For Married Filing Jointly—What Is It? HeavyNewspaper, The standard deduction for married couples filing jointly for tax year 2024 will rise to $29,200, an increase of $1,500 from tax year 2023. Page last reviewed or updated:

Source: www.chegg.com

Source: www.chegg.com

couples filing jointly. Standard deduction for, Taxpayers 65 and older and those who are blind can claim an additional standard deduction. For single taxpayers, the 2024 standard deduction is $14,600, up $750 from 2023;

Source: www.chegg.com

Source: www.chegg.com

Solved Using the married filing jointly status, _, and their, $3,000 per qualifying individual if you are married, filing jointly or separately. For married couples who file jointly, it will.

The 2024 Standard Deduction For Qualifying Surviving Spouse Is $29,200.

Additional amount for married seniors:

Tax Brackets 2024 Married Jointly Calculator Yoko Anatola, For Married Couples Filing Jointly, If Your Modified Adjusted Gross Income Is $32,000 To $44,000, Up To 50 Percent Of.

For 2023 (tax returns typically filed in april 2024), the standard deduction amounts are $13,850 for single and for those who are married, filing separately;