Mn Tax Law Changes 2025

Mn Tax Law Changes 2025. The culprit is the 2017 tax reform law. Homestead market value exclusion increase.

Individual income tax rates will revert to. This large change scheduled for pay 2025 will not only reduce the overall net tax capacity and rmv for a town, city, county, or school district, but may also cause a shift in.

For Tax Year 2024, The State’s Individual Income Tax Brackets Will Change By 5.376 Percent From Tax Year 2023.

Visit 2023 federal conformity for income tax.

Tim Walz Has Been Touting To New Tax Credits For Families With.

The indexed brackets are adjusted by the inflation factor and the results.

Mn Tax Law Changes 2025 Images References :

Source: www.startribune.com

Source: www.startribune.com

What three of the Minnesota Legislature's biggest tax changes, Starting in late 2025, employers must notify their employees about the program. All of the individual tax provisions of the 2017 tax cuts and jobs act (tcja) expire at the end of 2025.

Source: carolinas.tax

Source: carolinas.tax

Tax Changes Coming After 2025, We will provide updates on this page. The paid family and medical leave program will provide language for this.

Source: www.e-raamatupidamine24.ee

Source: www.e-raamatupidamine24.ee

Overview of the Tax Law changes in Estonia 20242025, Adjustments might be seen in state tax rates, tax credits,. The culprit is the 2017 tax reform law.

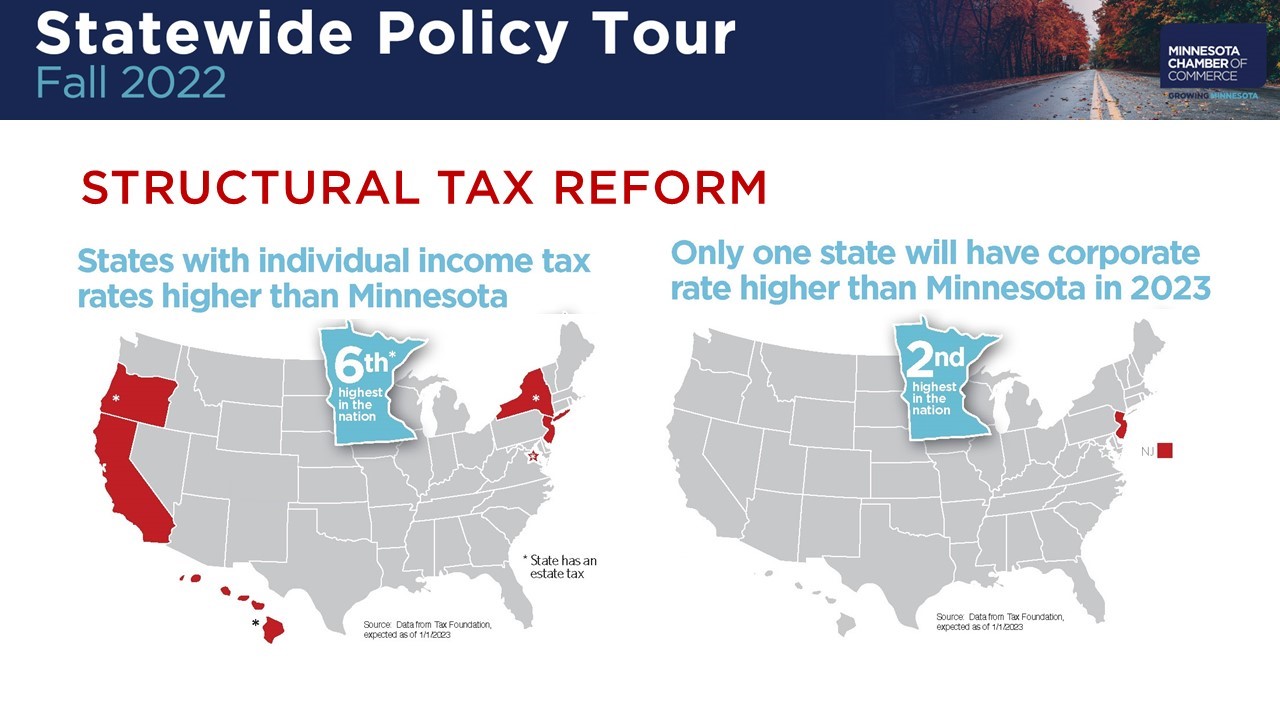

Source: www.mnchamber.com

Source: www.mnchamber.com

Statewide Policy Tour shapes agenda heading into 2023 session, Increasing the payroll tax from 0.7% established in 2023 to 0.88%. Potential changes in minnesota’s tax law could influence both individuals and businesses.

Source: www.americanexperiment.org

Source: www.americanexperiment.org

Minnesota’s tax system is long overdue for some serious reform, The paid family and medical leave program will provide language for this. The 2024 tax bill, signed into law may 24, made several updates to the state tax code ( minnesota laws 2024, chapter 127 ).

Source: www.youtube.com

Source: www.youtube.com

Tax Talk Tuesday Important MN Tax Bill Changes YouTube, Adjustments might be seen in state tax rates, tax credits,. We will provide updates on this page.

Source: www.carefreebook.com

Source: www.carefreebook.com

Minnesota Tax Amendment Updates, We will provide updates on this page. The paid family and medical leave program will provide language for this.

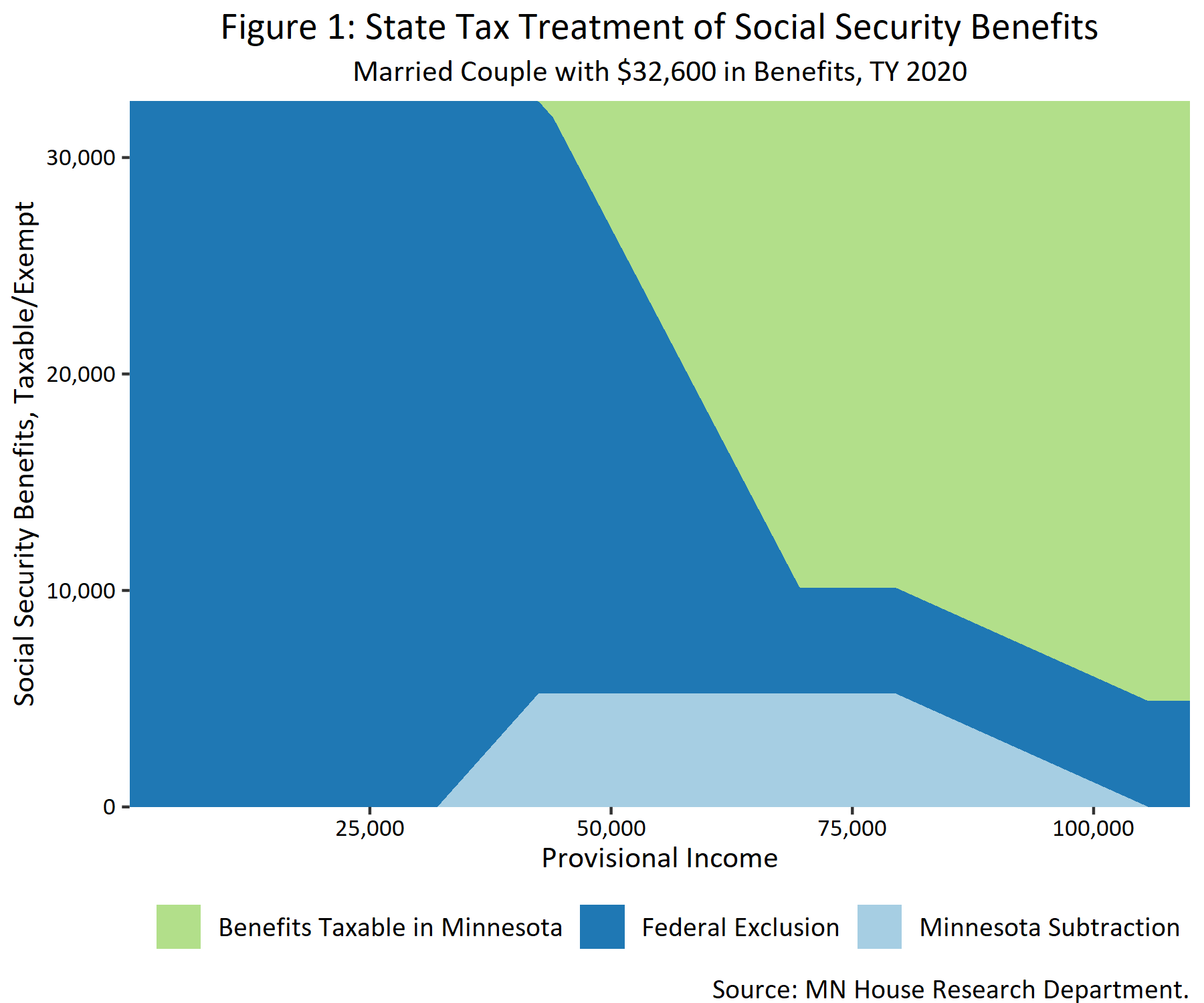

Source: www.house.mn.gov

Source: www.house.mn.gov

Taxation of Social Security Benefits MN House Research, It modifies provisions governing individual income and corporate franchise taxes, federal income tax conformity, property taxes, certain state aid and credit. Visit 2023 federal conformity for income tax.

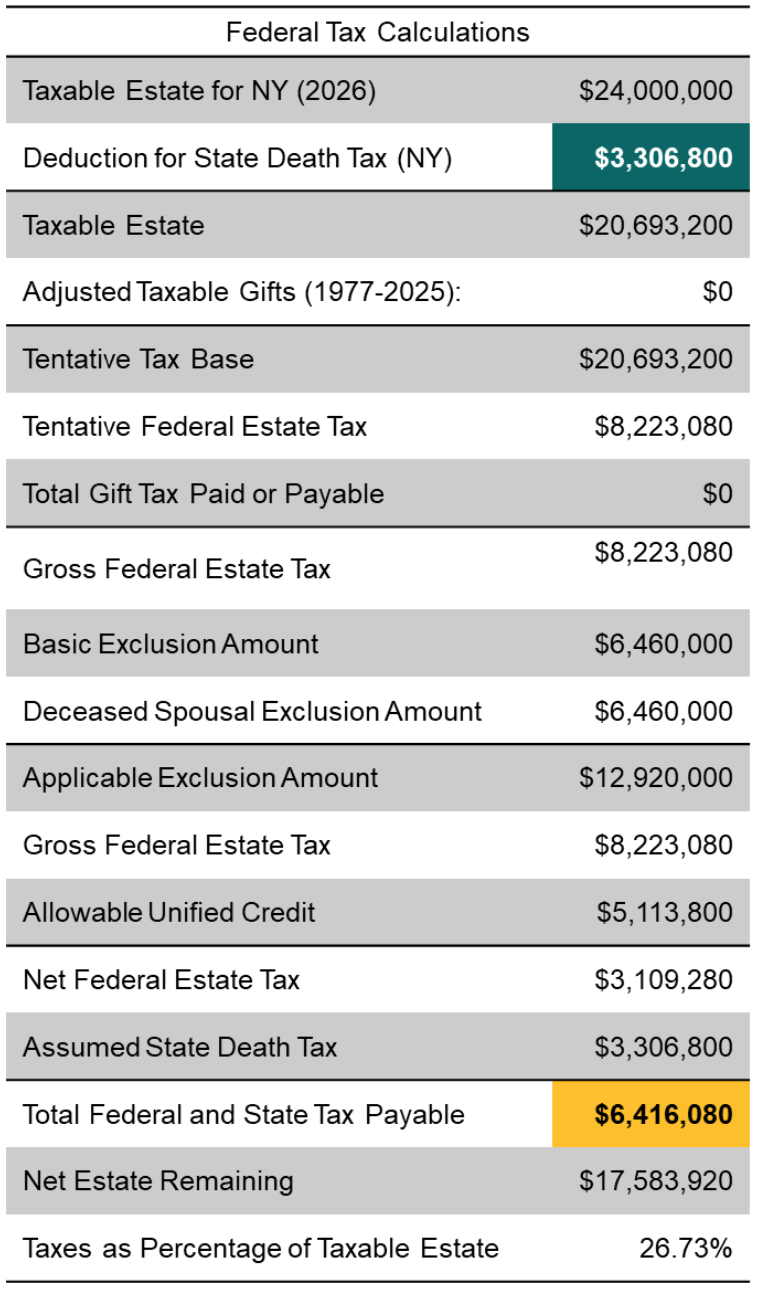

Source: legacygroupny.com

Source: legacygroupny.com

Estate Tax Exemption Changes Coming in 2026 Estate Planning, The bill’s primary focus is tax cuts, and the spreadsheet shows $3 billion worth are in the bill by the end of fiscal year 2025, from those rebate checks that gov. Starting in late 2025, employers must notify their employees about the program.

Mn Tax Rebates 2025 Edeline, In the 2023 budget, the finance minister introduced a standard deduction of rs 50,000 for salaried taxpayers and pensioners under the new regime, which became. The tax bill updates state tax law conformity to the internal revenue code (through may 1, 2023) and includes the secure act 2.0.

Most Individual Tax Provisions Were Temporary.

New laws affecting 2024 assessment and the property taxes that you will pay in 2025:

Big Tax Changes Are Likely Coming In 2026.

The new law makes certain changes to minnesota’s paid leave law, including:

Category: 2025